Growing Older

Growing older is not fun, responsibilities mount and the dream of staying forever young fades. As we evolve through each stage in life, the investment strategies required to achieve our financial goals should also evolve.

When you hit 30, it’s time to do away with the shenanigans of your teens & twenties and start to really settle down with life. Maturity and responsibility come with being in your 30s. Most people are introduced to financial responsibilities in their 30s. At this age, people start to think about getting married if they aren’t already, having children, buying a home, and having a retirement plan.

Your financial responsibilities influence how you invest. A woman in her 30s looking to start a family soon will not invest the same way a 25-year-old man with no commitments will. The demands of life at different ages influences our investment decisions.

All things being equal, you’re probably earning more in your 30s to start building an investment portfolio. If you’re at this stage and wondering about what asset classes to include in your investment portfolio, here are 5 asset classes to consider.

Fixed Income Assets

fixed income assets are a good start. Fixed income assets are debt instruments that return a fixed amount quarterly, semi-annually, or annually. Some examples of fixed income assets include bonds, commercial papers, treasury bills, and other forms of debt instruments.

Debt instruments are assets the government, corporate organizations and multilateral institutions employ to raise funds for long term and short-term needs from investors. The issuer/borrower, which could be a sovereign government or corporate organization issues a fixed income instrument to borrow funds from investors, offers a fixed interest return payable at fixed intervals and pays back the funds borrowed (capital) at the maturity of the asset. Most fixed income assets are low risk assets and so they are a good fit for investors starting out on their investment journey.

Fixed income assets are liquid, available in multiple currencies, and they pay returns on a regular basis making them ideal for investors in their 30s who will also need to build emergency funds to cater to life eventualities.

Mutual Funds

When you’re in your 30s, you have time on their side so you can take advantage of the benefits of compound interest. One of the few financial instruments that compounds interest are mutual funds.

Mutual funds are funds pooled from different investors and invested in assets like stocks, bonds, treasury bills etc. Mutual funds are professionally managed by fund managers, making it a good fit for investors who do not have the time to actively monitor their investment portfolios. The fund manager does the necessary research, decides on the securities to invest in and monitors the performance of the fund.

Interest returns on mutual funds are paid quarterly and investors have the option of reinvesting these returns in the fund. Mutual funds work well if you’re in your 30s and looking to build a retirement plan that will take advantage of the benefit of compound interest.

Equities

Equities or stocks, as they are commonly called, are units of shares of companies listed on a stock exchange. They are risk assets that give attractive returns over the long term. Investors benefit from owning stocks by earning dividends paid by the company they invested in and capital gains from the growth of a stock.

In your 30s, you have a long-term investment horizon than someone in their 50s, but you still must decide if you have the risk appetite to invest in the stock market. If you’re risk averse, you can focus on investing in Exchange Traded Funds (ETFs) or mutual funds that invest in stocks. You can also build an investment portfolio that balances out risk with a healthy dose of low-risk assets vs high risk assets. All in all, it is important you have a good sense of your risk appetite before you make key investment decisions like investing in the stock market yourself. Speak to a financial advisor if you need advice on how best to have a balanced investment portfolio.

Real Estate

Real estate is a great asset class for a growth investment portfolio. It is relatively inflation-proof and typically appreciates in value over time if you invest at the right price.

If you live in a developed economy, you should take advantage of access to mortgages loans with low interest rates. The interest rate on mortgage loans moves simultaneously with the prevailing interest rate in the economy. If the prevailing interest rate in the economy is low, mortgage rates are low and vice versa.

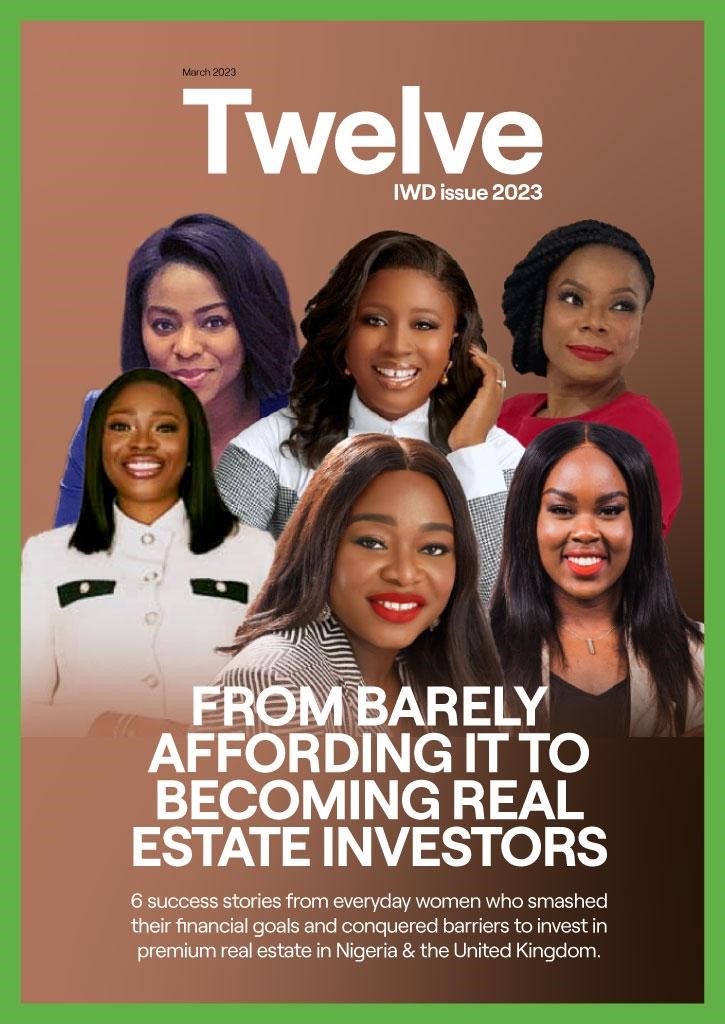

In emerging economies like Nigeria, where mortgages are almost non-existent, real estate is a high-ticket asset which most investors in their 30s may not be able to afford. However, don’t count yourself, look out for opportunities to collaborate with friends & family or work with investment clubs to co-invest in real estate properties with great prospects.

Wrapping it up

To have a good structure for your investment portfolio, start with a financial plan. A financial plan helps you define your short term & long-term financial goals and provides guidance on what asset classes you should consider in relation to achieving your financial goals.

Organizing your finances and making investment decisions can be a daunting task, if you are not sure about how to get started, you can consult a financial advisor or join an investment community where you’ll get proper financial education and connect with people of similar interest.

Finally, it is important to also explore investing in assets denominated in stable currencies. Investing in assets denominated in stable currencies preserve the value of your investment and the return on investment.

A stable currency is a currency that has retained its purchasing power relatively over time. The dollar is one of the most stable currencies in the world, it is the reserve currency in most developing countries mainly because of its stability.

We hope this helps you get started with creating an investment portfolio that helps you achieve your financial goals in your 30s